Based on existing positions in both the futures and stock markets. On the other hand, this is an asset that makes it possible to earn money not only on the directional movement of exchange instruments (on an increase when buying and on a decrease when selling), but also on movement in any direction, the market being sideways, or even when prices do not reach certain levels.

You need to start learning how to trade options from the moment you purchase the first share (or futures), since options help control risk much more effectively than stop orders, and success in stock trading depends on how much the trader is able to minimize risks.

At its core, an option resembles insurance. Imagine that when you buy shares, you can enter into an exchange agreement for a month for the opportunity to sell your shares back at a pre-agreed price (strike price), if the share price, for example, does not rise. Moreover, the cost of such an agreement will average 3-3.5% of the value of the shares. If the price of the shares rises, then the profit on the shares will be formed, minus the cost of the option (since executing the sale at a lower price is impractical). Options perform approximately the same role as “exchange insurance”; by the way, their cost may be lower.

Organization of options trading

Options trading on the exchange takes place on the derivatives market, where futures contracts are also traded. Profit/loss on options is generated according to the principle of accrual/write-off of variation margin at 19:00, and transactions are concluded by reserving collateral (GS), the same as when trading futures contracts. Options trading also takes place from 10:00 to 23:50 according to the derivatives market schedule.

An option is the right to carry out a transaction with an underlying asset under pre-agreed conditions (according to the specification) until a certain date in the future (expiration date).

Rice. 1. Specification of an option on futures on Gazprom shares

Futures are the underlying asset for options. On the derivatives market, options are presented on the same assets as futures: stock indices, currencies, commodities and the most liquid stocks. And since there is almost no difference between the dynamics of stocks and futures for these stocks, an option on a futures can insure stock positions.

Rice. 2. Comparison of stock dynamics and futures for Gazprom shares

Types of options and options for their use

Options come in two types: call and put. A call option is a contract for the right to purchase an asset before a certain date in the future at a price and quantity determined at the current moment. A put option is a contract for the right to sell an asset before a certain future date at a price and quantity determined at the current moment.

Those. If you bought a futures or a share, and the price of the asset went down, then, having a put option (the right to sell), you can write off the existing asset that has fallen in price at the price specified in the option - the so-called “strike” price.

Similarly, if you have a short position on an asset and a call option (the right to buy), you can close the position at the strike price if the price of the sold asset moves negatively.

Information on options is presented in the form of option desks, where the strike prices (at which futures transactions will be made) are presented in the center; in the green field on the left - call options; in the red box on the right are put options. Conversely, for each strike, option prices are presented: theoretical price (recommended by the exchange), demand ( best price demand) and supply (best offer price). The remaining prices (not only the best ones, indicating volumes) can be viewed in the order book of the corresponding option.

Rice. 3. Providing trading information on futures options on Gazprom shares

Buying options. It is worth saying that you can trade options without the underlying asset. In this case, profit from a call option is formed when the price of the underlying asset rises above the strike price by values higher than the value of the option itself. To the extent that the price exceeds the given value, this will be the profit on the call (you will have the right to buy the asset at a price lower than the current one). Moreover, it does not make much difference exactly how the price will increase. The price can first fall as deep as you like or immediately increase. The price needs to rise before the option expires (before the expiration date).

Rice. 4. Making a profit on a call option on futures on Gazprom shares

To make a profit on a put option (the right to sell an asset), the price of the underlying asset must fall below the strike price of the put itself. A decrease greater than the indicated one will be a profit on the option (you will have the opportunity to sell at a higher price than the asset is currently worth). And it doesn’t really matter how this decrease occurs; the price needs to decrease before the option expires.

Rice. 5. Making a profit on a put option on futures on Gazprom shares

Selling options. Options can not only be bought, but also sold, thereby making money on the non-movement of an asset to the strike price. If you believe that the market will not rise above a certain level (levels can be taken above the current price) before the expiration date, you can make money by selling a call option with the corresponding strike price. If you believe that the asset will not fall in price below a certain level before the expiration date, then you can make money by selling a put option with the appropriate strike (the strike price can be taken below the market).

Rice. 6. Making a profit on a sold call option on Gazprom stock futures

Profit/risk of option buyers/sellers. Thus, it turns out that the buyer and seller of options have different rights and opportunities. If the buyer of the option has the right to fulfill his contract (he may or may not exercise this right, for example, if it is inappropriate), then the seller of the option must fulfill his obligations for the amount paid by the buyer at the request of the buyer.

Rice. 7. Making a profit on a sold Put option on Gazprom stock futures

The risk of the buyer of options is the complete loss of the value of the option if execution is inappropriate (if the price does not go beyond the strike price of the option).

The risk of the option seller is the need to fulfill the buyer’s demand at an unfavorable price (if the option price went beyond the strike price of the option itself).

Thus, the buyer has unlimited profit potential when the value of the underlying asset moves above the specified strike in the direction of the option, but 100% risk if this movement is not realized before the expiration date. (But if you see that the movement is unlikely to go, you can sell the existing option, reducing your risk).

The seller of an option has a limited return (the amount paid by the buyer) by the value of the option itself, but unlimited risk if the price of the underlying asset exceeds the strike price by an amount greater than the value of the option. But the likelihood of the seller making a profit is higher, since the seller only needs to either move the asset in the opposite direction to the strike price, or not move the asset at all. The buyer makes a profit if the asset moves towards the strike price.

An example of making money on increasing volatility. Options can be purchased not only individually, but also in combination, forming a portfolio of options that will generate income in a more non-linear way. So, for example, if you buy both a call and a put at the same strike at the same time, then profit can be generated by any movement of the underlying asset, even if the price rises or falls by an amount exceeding the cost of acquiring both options. This happens because if it rises, the put option becomes worthless, and the call option becomes more expensive. And as soon as the call rises in price above the values of the put and call, a profit is generated. Likewise, if the value of the underlying asset declines, the value of the call depreciates and the value of the put increases. And as soon as the put rises in price above the cost of both options, a profit is generated. This type of option structure is called buying volatility.

Rice. 8. Making a profit from simultaneously purchased call and put options on Gazprom stock futures

Conclusion

To conduct successful exchange trading, training in options trading is highly desirable, since options help control risks. But in addition to risks, you can make money on absolutely non-linear variations in price movements by building various option structures, but this will require more experience.

What should be understood by the expression - options trading? Initially, the word “option” came from in English and it means “choice”. That's why, this term It is used in the field of stock trading and trading in options and option contracts.

Since the main feature is the ability to select the available conditions for its execution. In other words, this type of trading is all types of foreign exchange transactions with various option contracts, where all the existing conditions and risks are set by the trader himself, knowing that when the option contract is executed, he will receive a certain income.

These points distinguish option trading from regular trading, in which it is almost impossible to initially accurately predict what is to come and, as a consequence, what income or loss the trader will have.

Strategies for using options and their types

The use of options in trading is quite diverse. For example, they can be used as. Let's say you are in a long position with the euro. And here, instead of placing a “stop” order, you can purchase “put” and “strike” option contracts at the level of the calculated “stop” order, and if suddenly the price does not go up, then you will certainly lose your position on the spot, but make a profit on the option.

By combining different options, it is possible to create options that fully meet the requirements of investors.

For example, the “straddle” strategy consists of two options “call” and “put” with equal price execution and ending on the same day. The following condition is true for them: if their price rises, then the buyer will receive income from the “call” option, and if it decreases, then from the “put” option. This trading strategy may be applicable in the event of an upcoming strong market movement, for example on news.

The above options, as well as them in most cases, are used to hedge risks. That's why they are called "vanilla" which means vanilla. But in the market, there is no allotted small role and speculative or “exotic” options.

Such “exotic” options are quite diverse: there can also be barrier options (reverse knockin, reverse knockout, double no touch, one touch) and the like. Most of them do not have a strike price or denomination, but only the conditions under which the buyer has the opportunity to receive rewards.

For example, this condition: by making a payment of $10,000 today, you can receive $25,000, provided that the GBP/USD rate does not touch the 1.9000 point mark over the next 3 months. Also very common are the so-called “double impatiens”, when the conditions stipulate 2 levels with which the price should not come into contact. Such large options are often protected by various option barriers, which means that the buyer of the option sells the asset on the approaches, preventing the price from touching the barrier.

Also, deadlines option contracts and their location influence the market environment. Sellers of contracts try to prevent large options from expiring while still “in the money” and, as a result, try to push the price beyond the “strike” level at the time of its expiration, or touch option barriers, but buyers are trying their best to prevent them from doing this. As a result, the price rushes to the price levels at the time of their expiration.

Options Trading Strategies

Currently, there are many strategies options trading. We will discuss some of these strategies in this article.

"Interday" or contract for increase

This type of trading contract is concluded when there is a forecast for an increase within 1 business day. Here, the fixed net income ratio is 1.8, which is 80% of the profit when the contract is executed.

An example of a bullish trading contract.

They buy an “interday” contract for $100, with the condition of a further increase in the rate, in the time interval 15.00 - 17.00 hours. If this forecast comes true, then the total income will be $80.

"Interday" or down contract

This type of contract is concluded when predicting a future change in the exchange rate during the 1st working day for a decrease. In this case, the fixed net income ratio will also be equal to 1.8, which is 80% of the profit when implementing the contract.

2019-03-10

Many beginners who choose to specialize in trading are interested in what options are. Quality options trading training will make this financial derivative a favorite in your trader's arsenal.

In simple words you can tell about them by looking into history.

Here's an example. Options were bought back in Ancient Greece. Perhaps they were called differently, but the essence was the same.

A certain ancient Greek thinker Thales loved to observe the weather and make forecasts. One day he suggested that the next summer would be favorable for the growth of olives and that the olive harvest would be large. In a neighboring town, he bought the right to use olive presses next summer.

The olive harvest turned out to be rich, and Thales made money by subletting the presses. If the summer had been bad, there would have been no need to use the press; Thales would have lost the money he paid. This shining example OTC option.

The development of commodity-money relations led to the emergence of exchanges. They were created in different cities. There they traded the right to buy rice, tulip bulbs or other goods at a certain price within a specified period (double-sided, buy, sell options). When the purchase date arrived, buyers/sellers would buy/sell the item at the agreed price. But they could change their mind after losing money.

What is an option contract

An option or option contract is a security. It assures the right of one of the parties to fulfill the contract within the agreed period or to refuse the contract.

An option is based on an asset. It's not always physical product(securities, currency). The asset of an option contract can be the exchange rate, interest rate, stock index.

Types of options

Depending on the contract execution date, option contracts are divided into:

- European - fulfillment of the condition on the day specified in the contract;

- American – repayment occurs at any time before the due date.

The most common options are:

- stock exchange They are standard, their parameters are regulated by the exchange, only the price differs;

- stock funds with an underlying asset – a security;

- commodity, in which the asset is a commodity;

- financial with money as the underlying asset.

Other types of options: over-the-counter, index options, futures contract.

A separate topic is binary options. If you describe in simple words These options are a kind of financial instrument that allows you to make money on bets, on forecasts for price increases and decreases. We do not consider this type of options in this publication.

Options trading for beginners

It is not easy for novice traders to independently understand the nuances of options trading on the stock exchange. But options trading can be very, very profitable. Don't miss the opportunity to learn all the intricacies of working with option contracts. Experienced trainers will help you learn how to trade options and securities.

Risk-free options trading on the Moscow Exchange is possible after training with the famous trader Dmitry Brylyakov (). When trading using his system, it is impossible to lose money. This trading strategy allows you to start with small amounts and trade with minimal risk and high profitability using special robots.

For the broad masses of novice traders, such productive trading became possible with the development of weekly options. Previously, options were traded with expiration dates of only a month and a quarter.

Dmitry Brylyakov will explain what options are in simple words. He will teach you how to trade weekly options profitably.

Trading on the CME (Chicago Stock Exchange) futures contracts - .

Options trading carried out in the derivatives section of the Moscow Exchange, called FORTS - futures and options RTS. Trade turnover amounts to approximately 10%-15% of the total amount of all transactions carried out in this segment (the remaining share falls on trade). Options trading carried out within the framework of a standard exchange session.

On stock exchanges, options are quoted by value. The exchange offers for quotation a list of options with a certain set of strikes, which change with a set step.

The strike that is closest to the current spot rate of the underlying asset is called the central strike. For example, the current share price is 10.5 rubles, the option lot is 1000 shares. In this case, options with the following strikes are offered for trading: 9000, 9500, 10000, 10500 (central strike), 11000, 11500, 12000.

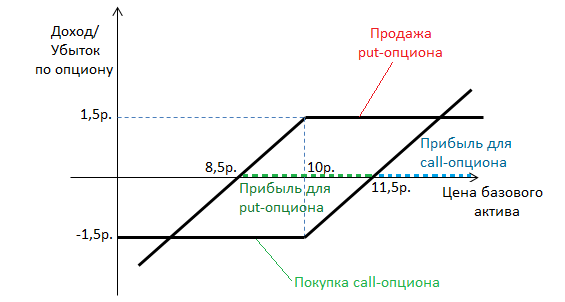

The income functions of buyers and sellers look like this:

Looking at the figure, we can conclude that options trading involves an asymmetric position of the counterparties in the transaction. Thus, option buyers have the opportunity to receive unlimited profits, and their losses are limited by the amount of the premium paid. The seller's maximum possible profit is the premium, and the potential loss is infinite. In view of the above, you may get the impression that selling options is not profitable, but this is not the case.

Example. Let the investor predict a slight increase in the stock price. Today the share price is 10 rubles. The investor has the opportunity to buy with a strike price of 10 rubles. and a bonus of 1.5 rubles. and sell with the same strike and premium. Which strategy should an investor choose?

Based on the plotted chart, we can draw the following conclusion: if a small price change is expected, then it is more profitable to sell options (i.e. in sideways trends). If significant price fluctuations are expected, then options are profitable to buy.

Options trading involves three states of this instrument depending on the ratio of the strike and the spot rate of the underlying asset.

For the buyer of a call option the following is true:

- If the strike is > the current market rate for the underlying asset, then the option is called an option “ without money" (or " for money"), i.e. with a loss;

- When is the strike?< текущего спотового курса, то опцион называется «in money" (or " with money"), i.e. with a win;

- If the strike is equal to the current market price of the asset, the option is called “ near the money».

For buyers of put options the following will be true:

- Out of money (without money, at a loss) if the strike price is less than the stop price;

- At the money (near the money, at breakeven) when strike = market price;

- In the money (in the money, in the profit zone) , if the strike is higher than the price on the spot market.

Options trading - how an option contract is executed on the Russian derivatives market

Let’s say that on the expiration date an investor sees that the option he previously purchased is not “in the money” and decides to exercise it. To do this, he needs to have funds in the futures account (which must be opened before purchasing the option agreement) equal to the initial margin on the RTS index futures multiplied by the number of futures, and the counterparty to the transaction must have the same account with a similar amount.

When a call option is exercised, the buyer takes a long position in the futures contract, and the seller of the option takes a short position in the same futures contract. The buyer of the call option is credited with a positive amount, and it is debited from the seller, at which point the option trading ends and the exercised options disappear.

When a put option is exercised, the buyer takes a short position on the futures, and the seller takes a long position. As a result of the transaction, the buyer of the put option receives a positive variation margin, which is debited from the seller’s account. From the moment the money is transferred, option positions disappear, and options trading is considered completed.

Options trading is carried out according to the following main strategies: (direct, proportional, inversely proportional, calendar), .

A very popular argument among critics of BOs is that they are not real. That's why you can't make money here. This is too superficial a judgment, because if you compare the conditions for trading options on the Moscow Exchange with those offered by binary companies, you can find arguments not in favor of the former. The article describes in detail all the differences on the basis of which one can draw a conclusion about the profitability of one or another option trading method.

What are stock options

Options traded in the forwards section along with futures are nothing more than a derivative instrument.

- To put it simply, this is the same contract as for binary options, but with minor differences. First, you need to indicate that here the contract can be sold at any time, without waiting for expiration. At the same time, the contract itself can be in three states at the time of sale:

- "Without money";

- "At the money";

"In money."

Exactly the same as in binary options, but a little more complicated. The diagram below shows how exchange option contracts work. To understand the scheme, it is enough to know what a Call option is and the strike price. When buying a Call, the trader has unlimited profit, but limited loss. Therefore, the more points the price passes, the. With Put option contracts the situation is completely opposite, but this does not mean that they are less profitable.

What is needed to trade on the Moscow Exchange

A trader cannot make transactions without resorting to the services of intermediaries. Intermediaries are brokers who offer their services for opening and maintaining client accounts. This leads to two disadvantages and only one advantage. The trader is insured against losing money, and this is a definite plus. However, this guarantee is valid only until the broker begins to use clients’ money to carry out transactions on the market. Then he begins to bear trading risks. The situation gets worse if the broker is structural subdivision jar. Banking risks are already involved here.

After opening an account for trading options contracts on the MICEX, the trader will have to become closely acquainted with all the delights of taxation. All completed transactions for the previous period will be summed up. If a trader makes a profit based on the results of this period, then he is obliged to pay 13% of the profit. This is a huge disadvantage

The second significant drawback is that the options trader on the MICEX is not protected from a negative balance. Here you can lose not only your own, but also other people’s money. In this case, lending may be used. Typically, loan money is provided by a bank. This is a serious risk for a beginner, so you should not start your trading career on the Moscow exchange. No matter what critics of binary options say, it is simply impossible to remain in debt to the bank, unless the client takes out a loan for the deposit.

How contracts are purchased

If on the BO a trader buys a contract from a broker at any time, then on the Moscow exchange this no longer works. Here the trader enters into a contract with a third party. All the necessary information can be found using the table. You can find out about available contracts from it.

What happens with such a trade organization? There is a shortage of liquidity, since options are not the most popular transactions among traders. That is why there are significant deadlines for the execution of contracts.

How is income from contracts calculated?

Compared to regular BOs, exchange ones seem very complex. This is true. Before trading them you will have to study a lot specific literature. First of all, you will have to learn the notation. For the absolute convenience of customers, they are designated by Greek letters.

Much attention should be paid to such a concept as volatility. Everything is simple in binary options. The profitability of the option is fixed, which removes uncertainty when trading

Exchange options are closely related to futures, so you will also have to deal with them. Not the easiest topics for beginners. Options on the stock exchange are not popular precisely because of their complexity. There are a lot of nuances here, which you need to understand not only by studying the relevant literature, but also by simultaneously gaining trading experience.

Where do you learn to trade these instruments?

You can learn how to trade stock options at the Moscow Stock Exchange. It will be good start, but lectures cannot be called everything a trader should know. There the necessary base is given, after mastering which you can move on to self-education.

Eat big choice high-quality and professional literature, reading which will give a trader much more than lectures. This requires additional time. Before you start doing this, you should think about whether it would be better to start investing. Currently, volatility in the market has dropped significantly, which has spurred many traders to change their trading strategies.

Conclusion

Binary options are more suitable for novice traders. They will allow you to gain the necessary trading experience, without a significant impact on your deposit. It is also worth noting the versatility of BOs, since starting with them you can clearly understand which assets are worth trading and where.

This greatly depends on the predisposition of the trader himself.

Thematic video

Green fish soup made from fresh cabbage with canned fish

Calorie content of steamed chicken cutlet Chopped chicken breast cutlet calorie content

Why do you dream about a small grave?

Why do you dream about a big ship?

What does Water in a dream mean in the Ancient Persian dream book of Taflisi?