The 1C Accounting 8.3 program is a very convenient tool for maintaining accounting records in an enterprise; it will help both a novice accountant and an experienced accountant not to make mistakes when maintaining records.

Let's consider the issue of recording and writing off fuel and lubricants in an organization and step by step reflect the actions of the accountant in the program.

Firstly, if a working car (or several) is listed on the company’s balance sheet, then a waybill must be filled out daily for each unit (maximum once a month). The driver or mechanic displays information about the car, the route, normal and actual gasoline consumption.

Secondly, gasoline consumption standards are calculated by an accountant for each car based on the standards of the Ministry of Transport and are fixed by order for the enterprise.

Thirdly, the receipt of fuel and lubricants is processed on the basis of primary documents: an invoice from the supplier (if an agreement has been concluded) or an advance report if the driver refuels the car for cash.

Algorithm of actions of an accountant in the 1C Accounting 8.3 program

- Registration of receipt of fuel and lubricants. Follow the path: /Purchases/ - /Receipts (acts, invoices) - button “Receipts” - Goods (invoice)

From the primary document, the invoice, we fill in the data: number and date of the invoice, name of the counterparty, agreement (if any), warehouse, nomenclature. Check the accounting accounts, the accounting account should be 10.03.

At the bottom left, record the invoice from the supplier.

You can view transactions generated based on the posted document using the icon

If an advance was transferred to the supplier, then the entry “Advance offset” is added Dt60.02 Kt 60.01

- Write-off of fuel and lubricants based on a waybill

Write-offs must be made according to the calculated rate

- Reflection of write-off of fuel and lubricants. Follow the path: /Warehouse/ - /Warehouse/ - Requirements-invoices- “Create” button

It is necessary to sum up the consumption for all waybills for a given driver and vehicle and enter the total quantity in the quantity column.

After posting the document, we create a balance sheet for account 10.03 and compare the remaining gasoline with the waybill issued on the last day of the month.

/ "Accounting encyclopedia "Profirosta"

@2017

20.06.2017

Information on the page is searched for by the following queries: Accountant courses in Krasnoyarsk, Accounting courses in Krasnoyarsk, Accountant courses for beginners, 1C: Accounting courses, Distance learning, Accountant training, Training courses Salaries and personnel, Advanced training for accountants, Accounting for beginners

Accounting services, VAT declaration, Profit declaration, Accounting, Tax reporting, Accounting services Krasnoyarsk, Internal audit, OSN reporting, Statistics reporting, Pension Fund reporting, Accounting services, Outsourcing, UTII reporting, Bookkeeping, Accounting support , Providing accounting services, Assistance to an accountant, Reporting via the Internet, Drawing up declarations, Need an accountant, Accounting policy, Registration of individual entrepreneurs and LLCs, Individual entrepreneur taxes, 3-NDFL, Organization of accounting

When deciding to use the 1C program on platform 8.3 - “Enterprise Accounting” for enterprise accounting, users must clearly understand what features they may encounter when using this software product. Accounting is based on the chart of accounts with its clear regulations for use. How to make the program use the chart of accounts as automatically as possible, minimizing manual labor and errors caused by the human factor? To do this, 1C developers came up with a register system that is configured before starting accounting, allowing you to avoid the above problems and achieve the most efficient user experience.

In this article we will get acquainted with one of the setting mechanisms for automatically substituting accounting accounts into primary documents. This mechanism is called “Register of information “Item Accounting Accounts”.

What is an information register?

This is a System object that stores reference information that is regularly used for substitution in documents. Thus, you can enter information in the information register once, and the System will use it an infinite number of times, while the user can “forget” about these registers altogether. Of course, forgetfulness is acceptable only if the registers are configured taking into account the specifics of the activities of a particular organization.

A good example of an information register is the “Currency Rate”, which stores such important information as foreign currency exchange rates against the ruble.

Information register entries can appear in the program in various ways:

- Downloaded automatically from the Internet, like exchange rates;

- Filled in manually by users as income tax rates;

- Filled in automatically after the first launch of the System as an item accounting account.

In the case of automatic completion, users must be sure that the setting available in the System satisfies the accounting requirements.

How can I view the setup of item accounting accounts?

The easiest access to item accounting accounts is through the chart of accounts:

The list contains not only elements of the chart of accounts, but also contains hyperlinks to go to information registers:

This is what the default information register “Item Accounts” filled out looks like:

What does it mean to set up the information register “Item Accounting”?

This register stores information about which accounting accounts should be entered into the primary documents of the System upon receipt, transfer, write-off and sale of items.

Synthetic accounting accounts are used in 1C in the register settings, which have the “Nomenclature” reference book in their analytical section.

Such accounts include:

- 07 – Equipment for installation;

- 08.04 – Acquisition of fixed assets;

- 10 – Materials;

- 20.02 – Production of products from customer-supplied raw materials;

- 21 – Semi-finished products of own production;

- 41 – Products;

- 43 – Finished products;

- 45 – Goods shipped;

- 002 – Inventory assets accepted for safekeeping;

- 003 – Materials accepted for processing;

- 004 – Goods accepted for commission;

- 005 – Equipment accepted for installation.

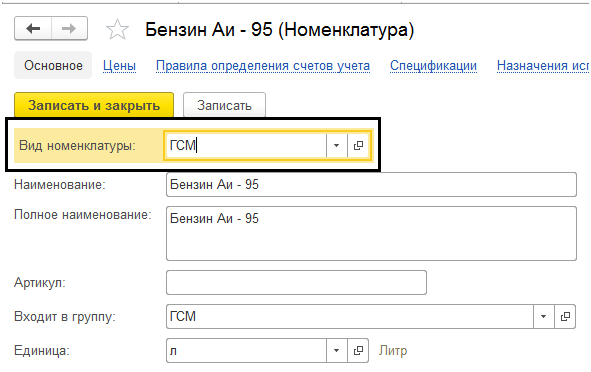

Each element of the “Nomenclature” directory contains the mandatory attribute “Type of nomenclature”:

Thus, for each type of item, you can match the accounting account.

Types of items are another key reference for setting up accounting accounts in 1C 8.3. This is what this directory looks like after initially filling out the System:

By default, it contains the necessary and sufficient number of elements, but users who have complex detailed accounting can supplement the directory with elements and set up item accounting accounts for auto-filling.

Using types of items, each entry in item accounting accounts can be interpreted as follows:

For any item card with the “Materials” type, for any organization, for any warehouse and warehouse type, when substituting this item in the primary documents, the item accounting account is 10.01, the transfer account is 10.07, etc. for each subsequent accounting account detail in the entry of this register.

If we turn again to the default entries in the information register, we will find, for example, for account 10 the use of only three subaccounts 10.01, 10.09, 10.10, and if the organization has fuel registered on account 10.03, spare parts on account 10.05, etc. P.?

How to set up item accounting accounts in 1C 8.3?

It is enough to add a new entry to the information register “Item Accounting Accounts”, in which you indicate the necessary, not previously used, subaccounts. This action seems simple only at first glance. After all, the new record must be unique in all respects, which means you need to add either a new type of item or a new warehouse to the System.

An example of setting up an item accounting account for fuel by item type:

The register record obtained in this way can later be used again for any item with the “Fuel” type, for any organization, any warehouse.

An example of setting up an item accounting account for spare parts by warehouse type:

The resulting entry in the register will be interpreted as follows: for any item located in the spare parts warehouse of any organization, item accounting accounts are filled out according to the specified parameters.

Thus, setting up item accounting accounts is a very important preliminary action, which it is advisable to carry out as completely as possible before the start of operation of the System.

Of course, over time, an organization may expand the list of used item accounts, so you will need to add new entries to the information register, choosing the most optimal strategy - adding a type of item, warehouse, or setting up accounts directly for specific item items.

It should be noted that direct indication of the item card information in the register is a special case. It is recommended for use when there is confidence that there will be a minimum number of such items in the nomenclature, and they will be quite unique.

All expenses of an organization or enterprise for accounting and tax purposes must be documented, otherwise, unaccounted expenses will be considered a serious violation, and the management of the legal entity may incur quite serious liability because of them.

This also applies to expenses for fuel and lubricants, and it is worth noting that if they are correctly calculated and executed, they can be included in the expense items of the balance sheet. As a result, the tax base used as a basis for calculating income tax may decrease.

The concepts of “fuel and lubricants” and “waybill”

Accounting for the movement of fuels and lubricants is directly related to waybills, while fuel and lubricants are understood as:

- fuel of various types, for example, diesel, gasoline, gas;

- oils and lubricants;

- various additives and additives, for example, cooling and brake additives.

A specific list of fuels and lubricants used in the operation of the vehicle, depends on its type and model. There are cars that run on gasoline and diesel fuel. In addition, some vehicles, such as buses, are equipped with gas fuel equipment to save money.

A specific list of fuels and lubricants used in the operation of the vehicle, depends on its type and model. There are cars that run on gasoline and diesel fuel. In addition, some vehicles, such as buses, are equipped with gas fuel equipment to save money.

In this case, gas also refers to fuel and lubricants. There are standards for their write-off, approved by the Ministry of Transport of Russia, and they can also be adopted by the enterprise independently. Such standards take into account some Extra options, for example, time of year and season, as well as various adjustment factors.

Accounting for these materials at an enterprise in most cases is carried out on the basis of the primary accounting document - waybill. A waybill is understood as a document that records the place of departure and arrival of motor transport, the consumption of fuel and lubricants, the name of the cargo being transported, the purpose of the trip and other information related to it.

The waybill is issued both for your own transport and for rented ones. In general cases, a waybill is used form No. 3, for commercial vehicles a form sheet is provided No.PG-1, when using a truck with a time-based form of payment, it applies form No. 4-P. There are also other forms of waybills.

In addition to the waybill for writing off fuels and lubricants, you need order of the head of a legal entity, which approves the norms for such write-offs. It is worth noting that the use of a personal car in the interests of the company is also issued with a waybill for writing off fuel and lubricants.

In addition to the waybill for writing off fuels and lubricants, you need order of the head of a legal entity, which approves the norms for such write-offs. It is worth noting that the use of a personal car in the interests of the company is also issued with a waybill for writing off fuel and lubricants.

The receipt of these materials to the enterprise is registered receipt order. The write-off itself usually occurs once a month by the person responsible for it. This person is almost always an accounting employee, for example, a material accountant.

As for the write-off procedure itself, it consists in drawing up a corresponding act by representatives of a commission specially created for this purpose in the number of at least three people.

Primary accounting documents are attached to it, namely: demand invoice, gas cards, gas station receipts. The purpose of these documents is to confirm the actual volume of consumed fuels and lubricants.

Calculation example

Calculation of the write-off of fuel and lubricants is carried out for each brand of motor vehicle separately, and the total mileage traveled must be taken into account. So, you can calculate for a passenger car using the formula:

QH = 0.01 * Hs * S * (1 + 0.01 * D), where

- H– basic fuel consumption rate, determined as vehicle mileage in liters per 100 kilometers;

- S– total vehicle mileage during a work shift in kilometers;

- D– correction factor in percent.

As an example, we can take the GAZ-3110 car, which is quite common in production, with a ZMZ-4026.10 engine. It has a basic fuel consumption rate of 13 liters per 100 kilometers.

As an example, we can take the GAZ-3110 car, which is quite common in production, with a ZMZ-4026.10 engine. It has a basic fuel consumption rate of 13 liters per 100 kilometers.

The car was used to sell finished products in the winter. The total mileage was 104 kilometers in the region (NR), and 128 kilometers in the city (HPg). As a result, a 10% surcharge was taken for operation in winter and for operation

We calculate the fuel consumption rate: HPg = (0.01 * 13 * 128 * (1 + 0.01 * 20%)) = 16.67 liters NPo = (0.01 * 13 * 104 * (1 + 0.01 * 10)) = 13.53 liters. According to the waybill, 30.2 liters were consumed during the working day. If we take this figure as an average, then the monthly consumption of fuel and lubricants for production purposes will be:

НРм = НРд * Т, where

NRM is the standard fuel consumption per working day, T is the number of working days in one month.

Thus, НРм = 30.2 - 21 = 634.27 liters.

In this case, when writing off fuel and lubricants, 623.27 liters of fuel may be indicated when the vehicle is operated for a month. As for the write-off of antifreeze, brake fluid, etc., they are written off in accordance with previously approved consumption standards.

It is also worth mentioning that in the event of a major overhaul of the vehicle or its service life reaches 5 years, the consumption rate of lubricants and fuel can be increased by 20%.

Is it possible to write off without a waybill?

There are cases when the write-off of fuel and lubricants is carried out without the use of a traveling person. This:

- accounting by limits;

- compensation for expenses incurred.

IN first case, the enterprise must be installed fuel and lubricants consumption monitoring system. In this case, reserved funds are allocated per unit of transport per month for their purchase.

Gas station fuel cards are also used for this, and the money on them should not exceed the established limit. This system is good when using vehicles on the same daily route.

In second In this case, it is necessary to conclude an agreement for the use of a personal car between the organization and its employee on the basis of Art. 188 of the Labor Code of the Russian Federation.

Here, payment restrictions are set depending on the make, model and modification of the car. The write-off of fuel and lubricants is carried out on the basis of the standards established by the enterprise.

Accounting Features

Before starting to write off fuels and lubricants, a legal entity needs to decide on the method of accounting for it. Thus, the car driver himself performs refueling using the funds allocated for this. After finishing refueling, he must submit an advance report to the accounting department. It comes with a gas station receipt. Fuel is subsequently accounted for account 10 “Materials”.

Consumed fuel and lubricants are reflected when written off to following accounts:

- 20 "Primary production";

- 26 "General running costs";

- 44 "Sale expenses."

The choice of one account or another rests with the management of the enterprise. At the same time, according to tax accounting, the operation of writing off fuel and lubricants is carried out according to Article 254 of the Tax Code and is included in material costs.

However, nothing prevents them from being classified as other expenses on the basis of Art. 264 Tax Code of the Russian Federation. In any case, it is worth deciding on the policy for accounting and writing off fuel and lubricants in advance, since these procedures are current and will be repeated periodically.

Step-by-step instructions for writing off fuel and lubricants in 1C are presented below.

Institutions and organizations with vehicles are forced to buy gasoline, diesel fuel and other fuels and lubricants every day. The most common ways to purchase fuel and lubricants are in cash or with an advance report, as well as using fuel cards.

Let's look at how these methods of accounting for fuel and lubricants are implemented in 1C: Accounting 8.3.

Accounting by cards

The plastic fuel card payment system is the most convenient and profitable form of payment for fuel. The organization enters into an agreement with a fuel and lubricants supplier for the purchase of gasoline using a fuel card, which stores information about the established limits on the quantity and range of petroleum products and related services, as well as the amount of money within which petroleum products and related services can be obtained.

Capitalization of the cost of a fuel card (if there is one, since in most cases the card is used free of charge if it is returned) can be registered as a receipt of services through the “Purchases” menu - “Receipts (acts, invoices)” - create a receipt “Services (act)” ).

Fig.1 Creation of the “Services” document

Fig. 2 Filling out a service document - production of a fuel card

In this case, the fuel card itself is taken into account as a strict reporting form on off-balance sheet account 006 and is reflected in accounting using a manual operation - menu “Operations” - “Operations entered manually”.

Fig.3 Operation entered manually – reflection of the fuel card as off-balance

Please note that if a fuel card is produced free of charge, the card is also displayed on off-balance sheet account 006 “Strict reporting forms” at a conditional price - 1 card = 1 ruble.

At the end of the month, the fuel supplier provides documents reflecting the number of liters actually purchased, which is the basis for accounting in account 10.03 “Fuel” and is issued through “Receipt of goods (invoice)”, in the “Purchases” menu - “Receipts (acts, invoices)” .

Fig.4 Menu of the 1C: Accounting program “Purchases”

We create a new document “Receipt of goods (invoice), fill in the organization, supplier, contract, warehouse and add rows to the tabular part “Goods” using the “Add” or “Selection” button. When creating an item, be sure to specify the type of item - fuels and lubricants.

Fig.5 Nomenclature card for fuels and lubricants

Fig.6 Registration of receipt of fuel and lubricants

Thus, we received fuel and lubricants from the supplier. The wiring has been formed - Dt. 10.3 - Kt. 60.

Fig.7 Movement of the document “Receipt of goods (invoice)”

Receipt of fuel and lubricants according to advance report

To reflect the driver’s independent purchase of gasoline using cash issued to him, we draw up an advance report. In this case, you first need to formalize the issuance of funds to the reporting employee. The issuance of money from the cash register is recorded in the document “Issuance of cash” with the type of operation “Issue to an accountable person.”

Fig.8 Filling out the cash withdrawal document

Now let’s create the “Advance report” itself through “Bank and cash desk” - “Advance reports”.

Fig.9 Cash documents

Using the “Create” button, we create a new document in which we fill out the first tab “Advances”: we record the document for issuing the advance (we have “Cash Withdrawal”), and at the bottom – the documents attached to the report. Next, we proceed to filling out the tabular part, in which we select the purchased product range (Ai-95 Gasoline), indicating the quantity and price.

Fig.10 Filling out the report

Thus, we capitalized fuel and lubricants through an advance report. His postings are Dt. 10.3 - Kt. 71.01. By clicking the “Print” button we get a printed form of the document.

Fig. 11 Printed form of the expense report

Write-off of fuel and lubricants in 1C 8.3

Accounting for the write-off of fuel and lubricants in 1C is carried out according to waybills. This information is verified with reports provided by the reporting employee himself and summarizing the data from waybills and gas station receipts.

The write-off of gasoline and other fuels and lubricants is documented in the same way using the “Demand-invoice” document, which is located in the “Warehouse” section.

Fig. 12 Fragment of the “Warehouse” menu item

In the document, using the “Selection” or “Add” button, the name of the fuel, volume and account to which we will write it off are indicated. The latter, in turn, depends on the type of activity of the company: for example, if the company is a trading company, then the write-off account is 44.01, production (for main production) is 20, and general business needs is account 26. Checking the “Cost accounts” box on the “Materials” tab, will make it possible to indicate accounts on the same line with the nomenclature. Otherwise, they will be filled out on a separate tab.

Fig. 13 Filling out the “Requirements-invoice” for writing off fuel and lubricants

When making an invoice claim, the cost of gasoline written off as expenses is taken into account at the average cost.

Fig. 14 Report on the movement of the document “Demand-invoice”

The same document can also be generated on the basis of an expense report. To do this, open the report itself or the entire “Advance reports” journal, click the “Create based on” button and select the document you are looking for.

Fig. 15 Creating a “Requirement-invoice” from an “Advance report”

Setting up subaccount 10.03 “Fuel”

In our example, we use one warehouse for fuel receipt. If you have several vehicles, then you can create your own warehouse for each vehicle and take into account the balances and turnover for each unit of transport.

In order for accounting on account 10.03 to be carried out in the context of warehouses, let’s look at the account settings in the chart of accounts. Let's open the account 10.03 – “Fuel”. Here, the composition of subconto types is determined by setting up the chart of accounts “Inventory accounting”. By checking the “Inventory accounting is carried out by storage location” checkbox, we receive an additional sub-conto in the form of warehouses, accounting for which can be carried out both in quantitative and quantitative-total terms.

Fig. 16 Setting up the “Storage Locations” subconto of account 10.03 “Fuel”

Fig. 17 Window for setting up the chart of accounts – account 10.03 “Fuel”

For example, let’s repost our created documents, changing the “Main warehouse” to the “Car” warehouse. After these changes, “Warehouse” was displayed in the transactions, and when creating the balance sheet, it became possible to add the “Warehouses” subaccount.

Fig. 18 Setting up the balance sheet for account 10.03 “Fuel”

As you can see, in the SALT the conditional warehouse “Car” was allocated.

Fig. 19 WWS for account 10.03 “Fuel” with details by storage location

Previously purchased fuel is reflected in the SALT without indicating the warehouse - “...”.

Accounting entries are generated. The correctness of accounting is determined by the correct formation of these entries.

Initially, when you first install the program, the posting generation mechanism is configured automatically and is designed for universal use. Sometimes this is enough to start working in the system. But as you work, situations inevitably arise when the standard settings are not enough and you need to change something, adjust it to your needs.

Let's look at how to change the settings of the posting generation mechanism or add new settings for operations related to items and counterparties.

Setting up Nomenklatura accounting accounts in 1C 8.3

To find the settings, go to the 1C 8.3 directory “” (menu “Directories”, then the link “Nomenclature”). In the list form, at the top, there is a link “Item Accounting”, click on it:

Let's look at the columns of this list. If the program maintains accounting for several organizations, the “Organization” column allows you to set up different accounting accounts for each of them.

For example, one organization is a manufacturer of some products, another is engaged in sales of these products or other goods, and a third uses products as materials in its own production.

In all these cases, different transactions can be generated for the same transaction, and, accordingly, different account settings will be required.

Get 267 video lessons on 1C for free:

Column "Nomenclature". Here we indicate the item group or specific item item for which the setting will be applied.

The “Warehouse” and “Warehouse type” columns indicate the warehouse through which movements occur, and settings are needed that apply only in this case.

Let's consider a common example: an organization is engaged in wholesale trade. The product range for wholesale is located in the “Products (wholesale)” group. Receipt and sale of goods occurs from the “Wholesale Warehouse” warehouse. You don't have to specify the warehouse type, since we will indicate a specific warehouse.

Click the “Create” button and fill out the form fields. I set up accounts in my 1C program as follows:

Let's create a document "" with the details corresponding to our settings:

The document shows that the default accounting account has become 41.01, but it can be changed if you need to capitalize the item to another account.

Let's run it and see what transactions the receipt document generated in 1C 8.3:

It can be seen that the wiring was formed in accordance with the settings.

So, to summarize, we can say that the set of accounting accounts depends on the combination of details Organization, Nomenclature, Warehouse and Warehouse Type.

By default, there is a line in the settings (in my example it is the first) that does not have any details at all. This setting works when no other combination is suitable. That is, the mechanism works as follows: the program first searches for suitable combinations with filled in details, with priority given to settings with the maximum set of conditions, and then, if nothing suitable is found, selects a universal setting without details.

This should be taken into account when creating a new item group or, for example, a warehouse. After creating a new object, the program will not find it in the settings and will apply the universal setting.

.JPG)

.JPG)

.JPG)

.JPG)

.JPG)

Niyat in Islam: the role of intention in assessing our actions

Is it possible to read the Quran quickly?

There is no way to pay the loan - what to do?

Prayer for longing for a person

Prayer for drug addiction: what can it give?