Quite a lot of enterprises pay wages to their employees in cash from the cash register. However, it is not always the case that the employee is on site on the day he receives his salary. And the question arises of what to do with unpaid wages.

Based on clause 6.5 of Bank of Russia Directive 3210-U dated March 11, 2014, these amounts are subject to deposit. Please note that the new procedure for conducting cash transactions does not require deposited amounts to be deposited with the bank, however, these amounts, unlike salaries, will be taken into account in the cash limit.

An enterprise can independently set the period during which employees must receive their salaries. But this period cannot be more than five days. The dates of payment of the next salary are indicated in the settlement and payment slips or in the payroll.

On the last day of payment of wages, the entry “deposited” is made in the statement opposite the names of those employees who did not receive the money. The total amount deposited on this statement is indicated at the bottom of the statement, and the money can be returned to the bank.

The law does not specify the period within which the employer must pay the deposited salary. Therefore, the enterprise must indicate the procedure for issuing such amounts in the employment or collective agreement. Deposited wages can be paid to the employee:

- on the day when the next advance is paid,

- on the day when the next salary is paid,

- within a certain number of days after an application for payment is received from the employee (this period must be fixed by the employer in an employment or collective agreement or other local act). The application may be in writing or oral.

Depositing salaries in 1C Accounting 8 ed. 3.0

In the 1C Accounting program 8th edition. 3.0 salary deposition is reflected in a document of the same name. It can be created on the basis of a statement to the cash register.

According to the document, a posting is generated: Dt 70 Kt 76.04

If the amount of unpaid wages is returned to the bank, the program generates a document “Cash Withdrawal” with the type of operation “Cash Deposit to Bank”. Located on the “Bank and cash desk” tab.

According to the document, a posting is generated: Dt 51 Kt 50.01

And when paying the deposited salary, you must fill out the “Cash Withdrawal” document with the type of operation “Payment of Deposited Salary”. Also located on the “Bank and Cash Desk” tab.

The fact of salary deposition in 1C is registered in the configurations “1C: Salary and Personnel Management 8”, ed. 2.5 and “1C: Enterprise Accounting 8.2” using the “Organization Deposit” document.

Let's look at how to deposit a salary in the 1C: Enterprise Accounting 8.2 configuration. In order to deposit wages, you can generate the document “Salary Payment Statement” (“Salary” – “Salary Payment” or the “Salary” tab) (see Fig. 1).

Using the “Add” button, we create a new payroll statement. In the document that appears, select the type of salary payment “From the cash register”. Click “Fill”, then the “Calculate” button. The document is automatically filled in.

Next, for the employee whose salary needs to be deposited, we put the “Deposited” mark in the appropriate column. The mark can be changed either for an individual employee or for all employees displayed in the document at once.

We carry out the document “Salary Payment Statement”.

Based on this document, we will make a deposit.

Go to “Actions”, select “Create based on”, then select “Deposit of organizations”. The document will be located in “Salary” – “Salary payment” – “Deposit documents” (see Fig. 2).

The document for deposit in 1C is generated automatically, then we post it and look at the postings. The following posting is generated for the document: Debit 70 Credit 76.04, where subaccount 04 to account. 76 “Settlements with various debtors and creditors” is called: “Settlements for deposited amounts.”

The printed form of the document “Deposit of organizations” is the “Depositor Card”.

Rice. 2

Depositing salaries in 1C "1C: Salary and Personnel Management 2.5" occurs in the same way - the same as in "1C: Enterprise Accounting 2.0".

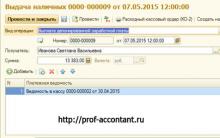

In “1C: Enterprise Accounting 3.0”, salary deposition can be created on the basis of the document “Statement for payment of wages through the cash register” (“Employees and salaries” – “Salary” – “Statements to the cash desk”) (Fig. 3).

Rice. 3

The document “Salary Deposit” (“Employees and Salary” – “Salary” – “Deposit”) (Fig. 4) indicates the statement according to which the salary is deposited in 1C and the list of employees.

Rice. 4

Salaries should be paid directly to the worker, unless there is another procedure outlined in the employment contract or legal provisions.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to know how to solve exactly your problem - contact the online consultant form on the right or call by phone.

It's fast and free!

In this case, the salary is paid at the place of work, or it is transferred to a certain bank account specified by the worker, again under the terms of a collective or labor agreement (letter of Rostrud dated March 6, 2012 No. PG/1004/6- 1).

In the latter case, non-payment of wages to an employee of the enterprise due to his failure to appear for it is impossible.

Thus, Salary deposit is an exclusive procedure in the event that it is accrued, but the employee did not receive it as stipulated. Such salary is subject to return to the banking institution. These are the rules of the Directive of the Central Bank of the Russian Federation dated March 11, 2004 No. 3210-U (hereinafter referred to as the Directive).

The reasons for depositing vary. This is a vacation or, simply put, a period of temporary incapacity for work. However, depositing is possible only when paying wages through deductions through the cash register.

Payments to employees via the cash register must occur within a clearly defined period. And it is limited to a maximum limit of 5 working days, including the day of receiving money at the bank (clause 6.5 of the Directive of the Central Bank of the Russian Federation dated March 11, 2013 No. 3210U).

If the issuance days fall on a non-working day or holiday, payments must be made the day before.

At the end of the last day of processing the payroll, the cashier affixes a “deposited” stamp opposite the initials of the employee who has not received his salary.

The deposited amount that was not issued is subject to return to the banking institution for the purpose of crediting to a personal account opened in the territorial bodies of the Treasury of the Russian Federation, however, only if the cash balance limit at the organization’s cash desk is exceeded.

As mentioned earlier, with non-cash payments, there is no question of depositing.

Salary deposit procedure

“Cash” wages are distributed according to the payroll (form No. T-53) or according to the payroll (form No. T-49). A sample of these documents can be found in Resolution of the State Statistics Committee of the Russian Federation dated 02/05/2004 No. 1.

The term of issue must be indicated on the first sheet of the statement.

The salary must be paid within a three-day period, which starts from the date of issue.

If any employee does not receive a salary at the end of this term, the amount is deposited and the statement is subject to closure.

After the issuance period expires, the cashier is obliged to:

Against the initials of the employees who did not collect their salaries, in the required section of the payroll statement, certify “deposited”, outline the amounts of paid and unpaid wages, compare these amounts and sign the statement.

Approve cash receipt order(in form No. KO-2, in accordance with Resolution of the State Statistics Committee of the Russian Federation No. 88 dated August 18, 1998) for the amount of salaries that were actually paid. Enter its details in the cash book.

Unreceived wages are handed over to the banking institution on the next day after the end of the term, which is allocated for its storage. When these amounts are deposited, an announcement about payment “in cash” is drawn up (form No. 0402001, approved by clause 6 to the Regulation of the Central Bank of the Russian Federation No. 318-P dated April 24, 2008 No. 318-P). For the amounts that were subject to delivery, a single expenditure cash order must be drawn up.

Beyond the term specified for the delivery of these amounts to the bank, it is possible to be held liable, expressed in the accumulation of cash in the cash register higher than a certain limit. According to clause 1 of Art. 15.1 of the Code of Administrative Offenses of the Russian Federation imposes liability for such a violation in the form of a fine of 4,000 to 5,000 rubles for officials (including individual entrepreneurs), and from 40,000 to 50,000 rubles for legal entities.

Example

At the end of the month, on March 27, 2015, employees of the enterprise received wages in the amount of 400,000 rubles. For payment, funds were withdrawn from the current account in the amount of 348,000 rubles dated 04/02/2015. This amount was credited to the company's cash desk for appropriate payments. At the same time, personal income tax was withheld and paid to the budget in the amount of 52,000 rubles (400,000 * 13%).

The cashier organized the payment of wages within a three-day period, from April 2, 2015 to April 4, 2015, according to the cash register dated April 2, 2015 No. 3. During this period, one of the employees did not receive it, but came for payment on April 18, 2015 , which was issued at the same time. The amount was 25,000 rubles.

That is, after April 4, 2015, the cashier deposited the latter’s wages.

And on April 18, 2015, according to a cash receipt order, the amount of salary in the amount of 25,000 rubles was taken from the banking institution and paid to the employee according to a cash receipt order.

Postings

Special accounting of salary transactions is a competent distribution of total values:

- If there are deposited amounts of money, posting Dt 70 Kt 76-4 is carried out.

- The reversion of the amount to the bank from the cash desk must be reflected by recording in the accounts Dt 51 Kt 50.

- When requesting payment of wages, the amount must be accepted back into the cash register account Dt 50 Kt 51, and must be issued to the working person Dt 76-4 Kt 50.

All transactions are for the same amount

In the event that wages are not claimed within the statute of limitations (3 years), the posting will be as follows: Dt 76-4 Kt 91 - that is, this will be an attribution of non-realized expenses. And if there is a deferred tax asset, the posting of Dt 09 Kt 68 to the subaccount “Calculations for corporate income tax” is carried out.

Depositing wages in 1C

If workers have not withdrawn their wages within the specified terms, the latter must be registered as a depositor.

In order to reflect this in accounting, the program first creates a “Salary Payment Statement” (the “Pay through the cash register” method), and fills out the document as usual. An employee who has not collected his salary is marked “Deposited”, the rest – “Paid”.

In order to display the deposit on Vedomosti, we enter the document “Deposition”. In this document, the operation of printing a deposit card is available. When carrying out the document, postings are generated for each employee according to Dt 70 and Kt 76.04 (“Calculations for deposited amounts”).

Subsequently, when a worker receives such a salary, the “Cash Expenditure Order” and the operation form “Payment of Deposited Salary” are entered into the program “manually”. In the case of cash settlement for the return of deposited wages, the posting Dt 76.04 Kt 50 is generated for the individual worker.

All transactions must be displayed in the “Book of Depositors” report, and all documents on depositors must be stored in the “Deposit Documents” journal.

Deadlines

As stated earlier, wages not paid to workers at the enterprise within the three-day period specified for this purpose are subject to deposit. After this procedure, the employee has the right to withdraw a similar salary at any time convenient for him, but within three years.

Payment of deposited wages

The deposited salary is issued according to a cash receipt order. At the same time, all essential information about the employee is entered into this paper, however, if there are several of them, then the best solution would be to draw up a separate payroll.

Transactions on such payments are subject to reflection by further entries:

debit of account 304 02 830 “Reduction of credit debt on settlements with depositors”;

credit account 201 34 610 “Retirement of funds from the institution’s cash desk”, 201 11 610 “Retirement of institution’s funds from personal accounts with the treasury authority.”

When calculating income tax, the written-off deposited salary must be included in non-operating income (Clause 18, Article 250 of the Tax Code of the Russian Federation). Income is recognized on the last day of the reporting period, in which the statute of limitations for debt confirmed by documents expires (subclause 5, clause 4, article 271 of the Tax Code of the Russian Federation). In this case, no differences arise between accounting and tax accounting. This is due to the fact that at the time of accrual, wages are included in expenses in both accounting and tax accounting. And when written off, both in accounting and tax accounting, the deposited salary is included in income. An example of writing off a deposited salary. The organization applies a general taxation system. Income and expenses are determined by the accrual method. At CJSC "Alfa", the period for issuing salaries is from the 5th to the 10th (inclusive) of each month.

Depositing wages in 1c

You can also fill out the document manually, but it is necessary that the deposit amount and statement be indicated correctly. When carrying out cash settlement services for the payment of deposited salaries, it generates a posting for each employee: Dt 76.04 Kt 50: Transactions on depositors are reflected in the “Book of Depositors” report (menu “Salary - Salary Payment” or the “Salary” tab): Documents on depositors are saved in the journal “ Deposit documents" (menu "Salary - Salary payment" or the "Salary" tab).

If the statute of limitations expires, the deposited debt is written off to the organization’s income using the document “Write-off of deposits to the organization’s income” (menu “Salary – Salary payment – Deposit documents” or the “Salary” tab). Source: Source: 1CStyle.ru – comprehensive maintenance of 1C:Enterprise software products.

Write off the balance in 1s 8 zup

Postings Dt 70 Kt 50 are generated for each employee: Now the “Salary Payment Statement” is reflected in the program as paid. If you open it, you can see that a payment document is indicated for each employee, and a payment document for the payroll is also indicated.

In addition, the paid statement cannot be changed. If, nevertheless, there is a need to change the paid statement, you need to find the payment document - in our case, RKO - and cancel it (or delete it).

After this, the statement will become available for modification. We must not forget that you will also need to make changes to the payment document or enter it again.

Paying salaries through the cash register using expense orders If you need to issue expense orders for each employee, you can use the appropriate processing.

Payment and deposit of salaries in the program "1C: Accounting 8 (rev. 2.0)"

For employees of the management apparatus, the deadline for issuing salaries is the 10th day of each month. This period is provided for in the collective agreement of the organization.

For February 2010, the organization's management staff received salaries from the cash register on March 10th. The financial director of the organization did not show up for his salary (he was ill) and did not receive the amount due to him (RUB 25,200).

This amount has been deposited. The amount of the deposited salary was handed over to the bank three working days after the salary payment deadline. The Alpha accountant reflected the deposit of wages in accounting: Debit 70 Credit 76-4– 25,200 rubles.

– the salary not received by the employee has been deposited; Debit 51 Credit 50–25,200 rub. – the deposited salary is handed over to the bank.

How to write off deposited wages

It is these documents that must be used to calculate the period during which the employee can request the deposited salary. The countdown must be carried out from the day following the last day of the salary payment period (Art.

191

Civil Code of the Russian Federation). This is explained by the fact that salary is an obligation with a certain deadline. The deadline in this case is the salary payment deadline.

And for such obligations, the limitation period begins at the end of the period for fulfilling the obligation (Clause 2 of Article 200 of the Civil Code of the Russian Federation). 2. Determine the expiration date of the statute of limitations (the day on which the deposited salary can be written off).

For an obligation in the form of a deposited salary, the statute of limitations is three years (Article 196 of the Civil Code of the Russian Federation). The legislation does not establish a special limitation period for this case (clause 1 of Article 197 of the Civil Code of the Russian Federation).

The procedure for writing off deposited salary not received by an employee

This article will discuss in detail step-by-step instructions for accounting salaries in 1C: preliminary setup, direct calculation and payment of wages in 1C 8.3 Accounting, as well as a salary project. If you figure it out, everything turns out to be quite simple. Content

- 1 Program settings

- 2 How to calculate salaries in 1C

- 3 Salary payment slip

- 4 Salary project in 1C 8.3

Setting up the program Before accruing and paying wages in the 1C 8.3 Accounting 3.0 program, you need to configure it correctly.

Important

To do this, select “Accounting Settings” in the “Administration” menu. In the window that appears, select “Salary Settings”.

This section allows you to set up not only your salary, but also personal income tax, insurance premiums and personnel records. Let's look at these settings in more detail step by step:

- General settings.

Payroll calculation in 1C 8.3 accounting step by step for beginners

It is completely filled out, a statement is indicated on the “Unreceived salary” tab, and a list of employees is indicated on the “Employees” tab. A printed form of the depositor card is available in the “Deposit” document.

When posted, the document generates a posting for each employee according to Dt 70 and Kt 76.04 (“Calculations for deposited amounts”): In the “Salary Payment Statement”, “Deposition” and RKO are indicated as payment documents: If an employee subsequently receives a deposited salary, in the program you must manually enter the “Cash expenditure order” with the transaction type “Payment of deposited salary”. To automatically fill in, click “Fill in – All unpaid documents.” Employees whose salaries were deposited, statements and amounts are automatically entered into the tabular part.

Zup write-off of old debts

Let's consider payment through a bank, since this method is the most common in organizations. In the “Salaries and Personnel” menu, select “Statements to the Bank”.

It will be discussed later. Next, click on the “Fill” button and after the data is automatically included in the document, enter it. See also the video instructions on how to pay an advance: And the calculation and payment of wages in 1C: Salary project in 1C 8.3 In the “Salary and Personnel” menu, in the “Directories and Settings” section, select “Salary projects” and create a new document.

It requires you to provide your banking information. The salary project for an employee is indicated on his card in the “Payments and Cost Accounting” section.

Calculation and payment of wages in 1s 8.3 accounting 3.0 step by step

In this example, we selected the “In this program” item, since otherwise some of the documents we need will not be available. The second setup option involves maintaining personnel and payroll records in another program, for example, in 1C ZUP. The “Salary Accounting Setup” subsection specifies the method of reflecting salaries in accounting, the timing of salary payments, vacation reserves, territorial conditions, etc.

- Salary calculation. Here we indicate that we will take into account sick leave, vacations and executive documents.

It is important to remember that this functionality will only work if the number of employees does not exceed 60 people. The types of accruals and deductions are also configured here.

For convenience, we will also install an automatic recalculation of the “Payroll” document.

- Reflection in accounting.

There are two main positions: unclaimed debt on deposited wages must be written off after three months in accordance with Art. 392 of the Labor Code of the Russian Federation; unclaimed debt on deposited wages is subject to write-off after three years in accordance with Art. 196 of the Civil Code of the Russian Federation. m231127 01-02-2011, 16:05:26 I have this situation - on account 70 there is a debt to an employee for 2007 - 52 kopecks! The employee quit a long time ago - can I write off this debt to account 91? And after what time do I have the right to write off the debt - after 3 years? because I also have a debt since 2009 - they did not pay an employee 360 rubles, and since the same 2009 - they overpaid one employee by 1 kopeck! I would like to somehow get rid of these tails, the question is, do I only have the right to write it off after 3 years? Yes, write it off and don’t bother.

Write off salary in 1s 8 salary upon expiration

After the expiration of the statute of limitations (3 years) in December 2014, we can write off as expenses debts owed to employees that have not been closed since 2011. Please tell me how this can be done in the ZUP so that they do not show up in the record vicof 1 - 12/24/14 - 16:24 You can make adjustments. Did you congratulate the chief accountant? b-dm 2 — 12/24/14 — 16:25 And then! Well, he congratulated me, I really liked it... the letter, it’s banal, but the contents are original)) b-dm 3 - 12/24/14 - 16:26 (1) and about the correction in more detail? what are we adjusting?) vicof 4 — 12/24/14 — 16:28 (3) Debts. I don’t remember what the register is called, mutual settlements, in my opinion.

Payment of wages through the cash register using a payroll To prepare for the payment of wages, use the document “Salary Payment Sheet” (menu “Salary – Salary Payment” or the “Salary” tab). If monthly salaries are paid, the document “Calculation of salaries to employees” must first be completed and posted. In the “Salary Payment Statement” you must indicate the month for which the salary is paid, the method of payment (through a cash desk or bank), as well as the department (optional). The tabular part can be filled out automatically or manually. To fill it out automatically, click “Fill – By debt at the end of the month”, then “Calculate”. The amounts payable to employees (minus tax) are calculated. Amounts are subject to change.

Cake with cottage cheese and sour cream in a slow cooker

Valui (mushrooms): preparation and salting Hot salting of valui at home

Round bread is outdated. Round bread. Sourdough bread recipe

Barberry compote for the winter Is it possible to cover barberry compote

Dietary recipes and dishes made from cottage cheese